What's Your company's Risk Management strategy?

Whether your business is in the Fortune 100 or a small home-based venture, risk management is crucial for profitability. Different sizes and scopes require varied considerations. For instance, a multinational company might focus on system failures or security breaches, while a small business might worry about overstocking or extending too much credit to customers. Effectively mitigating risk can significantly enhance profitability and ensure business continuity.

This article focuses on assessing and mitigating risk for larger companies with resources to track and report data regularly. If these capabilities are available but unused, the lack of risk management itself becomes a significant risk that senior management must address promptly and effectively.

Risk management often relates to software but is valuable in various organizational activities. Sometimes, the risk lies not in advancing new projects but in not advancing them. Should we ‘build it and they will come’ or wait for a client request? Such questions can be addressed in a risk matrix, which provides a structured approach for different types of assessments.

To reduce operational risk, use the three Rs: the Right Formula, the Right Tactics, and Repeatable Actions. These principles help create a systematic approach to identifying, prioritizing, and mitigating risks, ensuring that the organization is better prepared for potential challenges.

For the Right Formula:

- Identify and document known vulnerabilities.

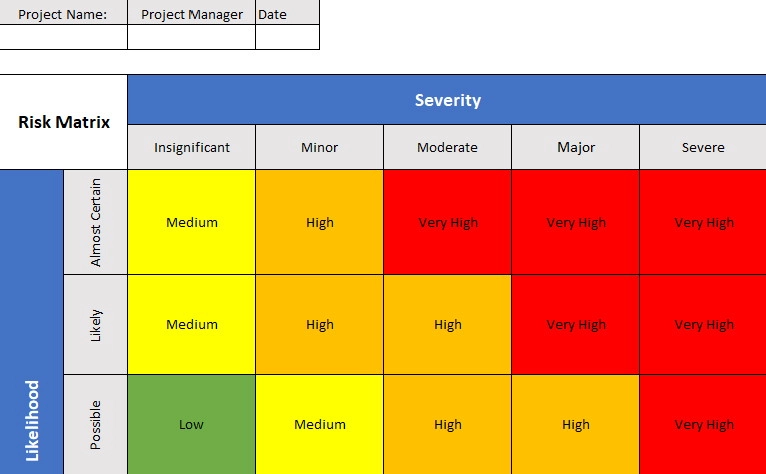

- Develop a scoring matrix to rate business risks.

- Prioritize remediation.

- Communicate with all stakeholders.

- Create project plans to mitigate issues.

The Right Tactics for implementing the Right Formula:

- Brainstorm with system experts to list all known or potential issues.

- Create a scoring matrix using criteria like Severity, Likelihood, and Impact.

- Align business leaders and IT teams to prioritize items.

- Document and publish details across the organization.

- Execute the plan.

By following these steps, you’ll have a customized action plan for achieving desired results. Repeat this exercise quarterly or annually to make informed investment decisions without risking the company.

A typical Risk Matrix includes the nature of the risk, its likelihood, severity, impact, remediation costs, and worst-case scenario costs.

Using operational metrics and scheduled system reviews helps determine the “Risk Factor” and the likelihood of future occurrences. High severity, likelihood, and impact require mitigation. If the impact is low, no action may be needed. This exercise is crucial for deciding risk acceptance.

Each business unit should create a Risk Matrix for every product or offering to get a global view of corporate risk. Business leaders prioritize these matrices to determine their importance. These documents can be combined to create an enterprise-level matrix for communication to senior management.

When senior management understands known vulnerabilities, new product prospects, and risks, investment decisions become less risky. The right process and data make this possible.

Implementing a Risk Matrix not only captures risk but also aids in year-end budgeting. It helps identify investment areas, even those typically overlooked. For instance, KTLO applications might seem trouble-free, but data may reveal potential risks to primary revenue. Engaging in this systematic technique improves risk decisions.

For example, one company used Risk Matrix data to find that a high-impact outage could cost $52 million per hour, while reducing that risk would cost only $1 million. They proactively invested based on this data.

A repeatable Risk Matrix process is not a one-time scramble but a purposeful approach to regularly assess risk posture, guiding investments, and ensuring client and employee satisfaction. Using the Risk Matrix for risk mitigation leads to a safer, more profitable company.

In conclusion, risk is omnipresent and can harm any business. By identifying and preparing for your company’s riskiest situations, you can manage risk aversion, avoidance, and acceptance, making risk a controllable factor in your decision-making process.